WASHINGTON — A survey conducted in August by the National Federation of Independent Business (NFIB) found that, while small-business owners are still not feeling massive amounts of recovery from their challenges, they are growing slightly more optimistic.

The organization reports that 29% of owners stated inflation was their single most important problem in operating their business. This is a decrease of eight points from July’s figures, which was highest reading for inflation since the fourth quarter of 1979.

The study also found that the NFIB Small Business Optimism Index rose 1.9 points in August to 91.8. While this marked the eighth consecutive month below the 48-year average of 98, it does show a reversal in some of the declines in the first half of the year.

“The small business economy is still recovering from the pandemic while inflation continues to be a serious problem for owners across the nation,” says NFIB Chief Economist Bill Dunkelberg. “Owners are managing the rising costs of utilities, fuel, labor, supplies, materials, rent, and inventory to protect their earnings. The worker shortage is impacting small business productivity as owners raise compensation to attract better workers.”

Other key findings in the report include:

- Small business owners are expecting better business conditions over the next six months improved 10 points from July to a net negative 42%, the highest level since February 2022. This outlook, the NFIB says, while improving is still not optimistic.

- The net percent of owners raising average selling prices decreased three points to a net 53% (seasonally adjusted), which, the NFIB states, is still a very inflationary outcome.

- The net percent of owners who expect real sales to be higher increased 10 points from July to a net negative 19%, but owners still want to hire.

Labor woes continue in the small-business sector, the study found, with 49% of owners reported job openings that were hard to fill, unchanged from July and remaining historically high. Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 21% planning to create new jobs in the next three months.

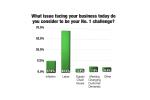

Seasonally adjusted, a net 46% of owners reported raising compensation, down two points from July. A net 26% plan to raise compensation in the next three months, up one point from July and historically very high. Ten percent of owners cited labor costs as their top business problem and 26% said that labor quality was their top business problem. Labor quality remains in second place behind “inflation” by three points.

The supply chain is still a source of concern, as well, with 32% of owners reported that disruptions have had a significant impact on their business. Another 33% report a moderate impact and 23% report a mild impact. Only 11% report no impact from recent supply chain disruptions.

The NFIB survey found that profit margins are another source of concern. The frequency of reports of positive profit trends was a net negative 33%, down seven points from July. Among the owners reporting lower profits, 36% blamed the rise in the cost of materials, 23% blamed weaker sales, 12% cited labor costs, 7% cited lower prices, 6% cited the usual seasonal change, and 4% cited higher taxes or regulatory costs. For owners reporting higher profits, 38% credited sales volumes, 35% cited usual seasonal change, and 13% cited higher prices.

Have a question or comment? E-mail our editor Dave Davis at [email protected].