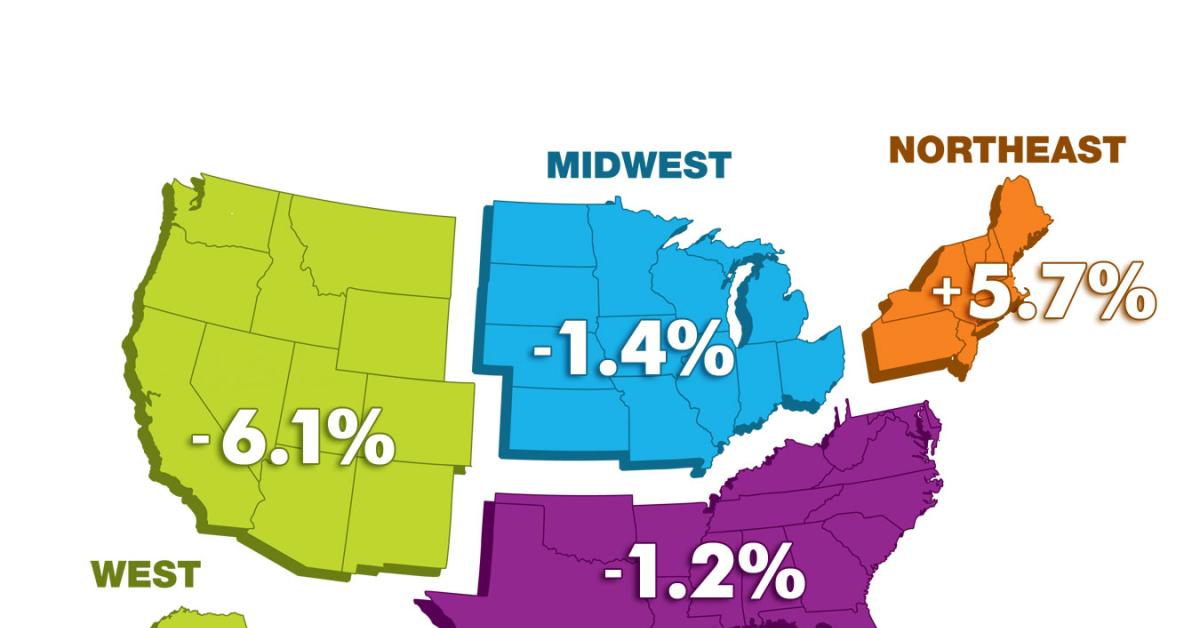

CHICAGO – The Northeast was the lone bright spot for September dry cleaning sales, posting a 5.7% gain compared to sales for September 2010, according to the latest AmericanDrycleaner.com StatShot survey.

In comparing September 2011 sales to September 2010, the South saw a 1.2% decrease and the Midwest a 1.4% decline. The West was hit the hardest, with sales down 6.1% from a year earlier.

“Even with aggressive promotions, sales continue to slide in Southern California,” reports a Western operator.

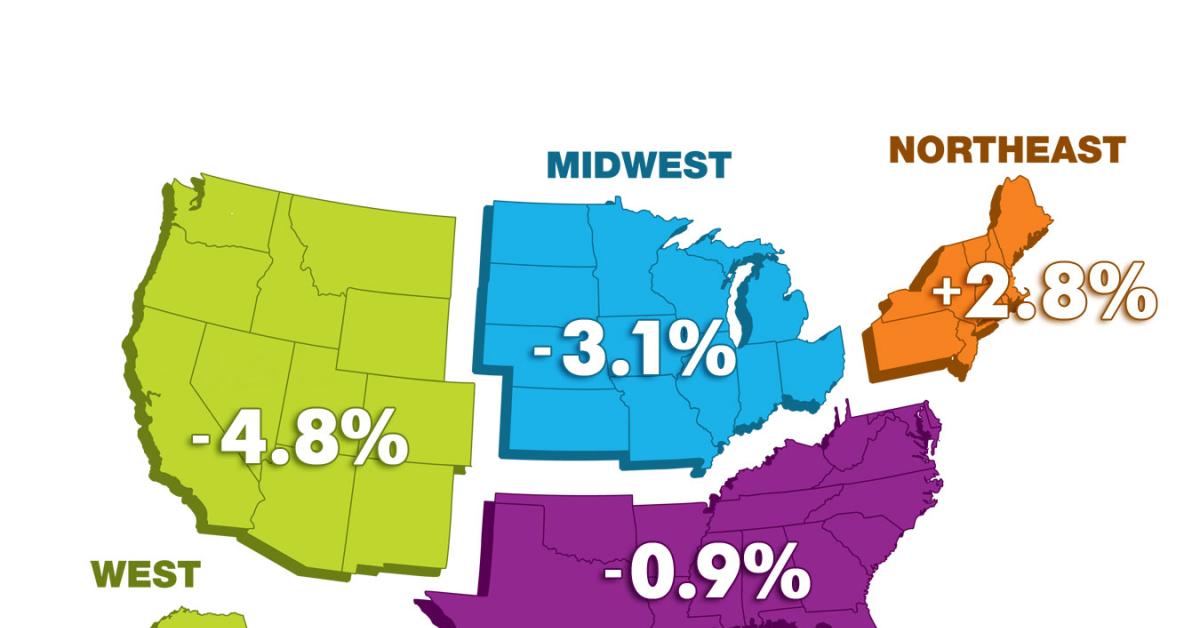

The Northeast was also the only region to post gains in third-quarter sales from a year ago. They were up 2.8%. The other regions reported declining sales when compared to the previous year’s July, August and September: South, down 0.9%; Midwest, down 3.1%; and the West, down 4.8%.

“Our business has been excellent,” reports an operator from the Northeast. “A contributing factor I believe is the Marcellus shale drilling and pipeline welding going on just over the (New York) border in (Pennsylvania). Even without that, business has been excellent.” Another operator has noticed an “increasing amount of ‘help wanted’ signs, especially for manufacturing plants.”

But it’s not all wine and roses in the region. “From 2008 to 2011, (we are) down 22%,” says another dry cleaner there.

In the regions posting smaller declines, comments were mixed.

“July was a train wreck, but August and September were both up months,” reports one Midwestern dry cleaner. “Continuing into October, sales are up as well. Maybe this is the end of three years of declines. It is too early to tell. Forecasting remains very difficult.”

A Southern operator says their business during the first two weeks of October was the best it’s been in two years. Another reports having benefited from a more aggressive marketing approach and the closure of a competitor.

A Midwestern operator was less optimistic. “Still no relief in sight for our industry. Still way too many dry cleaners to service a steadily declining total available volume.”

AmericanDrycleaner.com surveys the trade audience every month on a variety of issues facing the dry cleaning industry. While the StatShot survey presents a snapshot of operators’ viewpoints at a particular moment, it should not be considered scientific.

Audience members are invited to participate anonymously in these surveys, which are conducted online via a partner website. All dry cleaners are encouraged to participate, as a greater number of responses will help to better define industry trends.

Have a question or comment? E-mail our editor Dave Davis at [email protected].